The Fundamentals of the Mortgage Process for Lenders

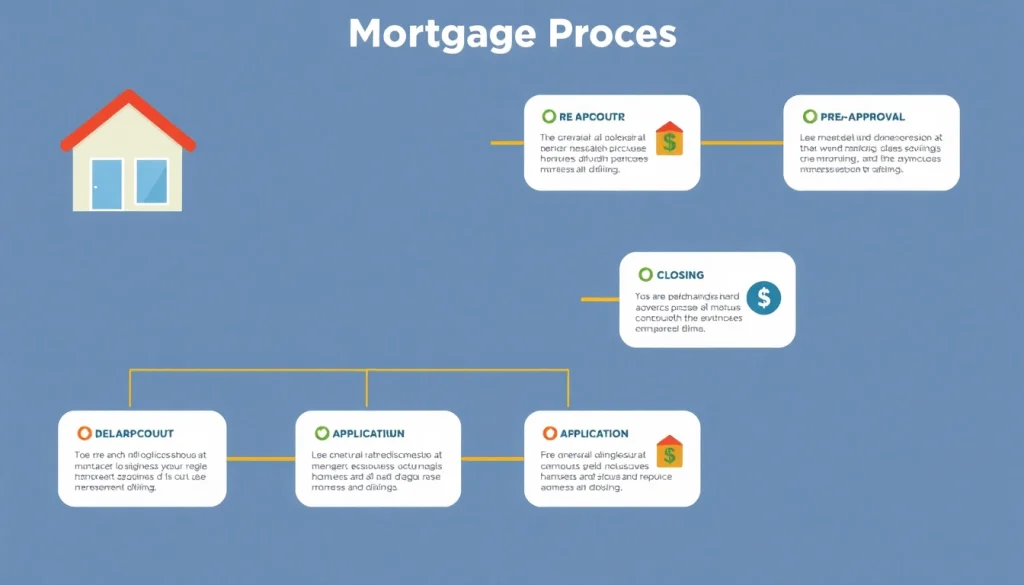

The mortgage process is a vital aspect of home buying that involves multiple steps, regulations, and obligations for lenders. By understanding the mortgage process for lenders, financial institutions can streamline their operations and better serve their clients. This section delves into the essential stages of the mortgage process, setting the groundwork for both lenders and borrowers.

Understanding Mortgage Pre-Approval

Mortgage pre-approval is the initial step in the mortgage process where lenders assess a borrower’s financial capability to repay the loan. This is crucial not just for borrowers looking to prove their seriousness to sellers, but also for lenders to gauge credit risk. The pre-approval process involves a thorough analysis of the borrower’s financial status and could include the following steps:

- Verification of income, assets, and employment status.

- Obtaining the borrower’s credit report and evaluating their credit score.

- Analyzing the borrower’s debt-to-income (DTI) ratio.

- Issuing a pre-approval letter that outlines how much the lender is willing to loan.

This letter carries significant weight in the home buying process, as it shows sellers that the buyer is financially capable and serious about purchasing a home.

The Importance of Credit Scores

Credit scores are a critical component of the mortgage process. They serve as a reflection of a borrower’s creditworthiness and financial responsibility. Lenders often use credit scores to determine the amount of risk they will assume in extending a loan. The three main credit bureaus—Experian, TransUnion, and Equifax—provide credit scores that typically range from 300 to 850. A higher score usually translates to better loan terms and lower interest rates. Factors influencing credit scores include:

- Payment history (35% of the score)

- Amounts owed (30%)

- Length of credit history (15%)

- Types of credit in use (10%)

- New credit (10%)

Lenders should actively communicate the importance of maintaining good credit scores to their clients, as it can significantly affect loan approval and terms.

Gathering Necessary Documentation

Once a prospective borrower is pre-approved, the next step is to gather the necessary documentation to complete the mortgage application. This documentation can be extensive and typically includes:

- Proof of income (pay stubs, tax returns, W-2s)

- Bank statements

- Identification (driver’s license or passport)

- Credit report access permission

- Asset documentation (investment statements, retirement account details)

Proper organization and maintenance of these documents can expedite the process and avoid delays during processing and underwriting.

Navigating the Mortgage Application

Filling Out the Mortgage Application

Filling out the mortgage application is a critical step in the mortgage process. This document collects vital information about the borrower and the property. Lenders must ensure accuracy and completeness by following these guidelines:

- Be precise with all personal information, including social security numbers and employment history.

- Clearly indicate the type of mortgage being applied for (fixed-rate, adjustable-rate, etc.).

- Input details concerning the property, including address, purchase price, and any pertinent disclosures.

A well-completed mortgage application is essential for smoothing the path toward loan approval.

Key Information Lenders Need

For lenders, obtaining the right information during the application process is paramount. It’s not just about assessing the borrower’s ability to repay the loan; it’s also about understanding the risk associated with the transaction. The key pieces of information lenders need include:

- Borrowers’ income and employment details, which help ascertain job stability.

- The value of the property, obtained through an appraisal, which ensures that it is sufficient collateral for the loan.

- The purpose of the loan (purchase, refinance), providing context for the financial decision.

Having complete and truthful information can significantly minimize complications as the process advances.

Common Application Pitfalls to Avoid

Despite the best intentions, mistakes often occur during the mortgage application process, which can lead to delays or even denial of the application. Common pitfalls include:

- Failing to report additional debt, which can falsely inflate a borrower’s perceived financial stability.

- Incomplete applications which can result in unnecessary delays.

- Misunderstanding loan terminology, leading to confusion about loan options.

Lenders should actively engage with borrowers to preemptively address these issues and ensure a smooth application experience.

Loan Processing and Underwriting Steps

The Role of Loan Processors

Loan processors play a crucial role in the mortgage process. They are responsible for collecting necessary documents, verifying borrower information, and ensuring everything is accurate and in compliance with regulations. Their tasks often include:

- Ensuring that all documentation is complete and submitted.

- Communicating with borrowers for any additional required information.

- Preparing the file for underwriting, ensuring it adheres to all lender’s guidelines.

Efficiency at this step can markedly affect processing times and the overall client experience.

What Underwriters Analyze

Underwriters are the final decision-makers regarding the mortgage loan. They conduct a thorough review of the application to assess risk. Key factors they analyze include:

- Credit score and history to evaluate the borrower’s reliability.

- Debt-to-income ratio to ensure the borrower isn’t over-leveraged.

- Value of the property, which determines the loan-to-value (LTV) ratio.

This comprehensive analysis is crucial for mitigating risk for lenders while also fulfilling compliance obligations.

Timeline Expectations for Processing

The mortgage processing timeline can vary depending on various factors, such as the lender’s policies, workload, and the complexity of the borrower’s financial situation. Generally, mortgage processing takes between 3 to 6 weeks after the application is submitted. Lenders need to set realistic expectations for borrowers to avoid frustrations. Routine updates to borrowers during this period can also enhance client satisfaction.

Closing the Loan: What Lenders Should Know

Understanding Closing Disclosure

The Closing Disclosure is a critical document that outlines the final terms and costs of the mortgage. Lenders must ensure that borrowers receive this document at least three business days before closing. Key components include:

- Loan terms and monthly payment amounts.

- Cash needed to close and any potential real estate taxes or homeowner’s insurance included.

- Settlement services and other fees that may apply.

Transparency in this document is essential for building trust between the lender and the borrower.

Final Steps to Secure the Mortgage

Closing day can be stressful for borrowers, and understanding the final steps can ease anxiety. Lenders should guide their clients through:

- Reviewing the Closing Disclosure for accuracy.

- Signing the necessary documentation, which may be done in person or remotely.

- Understanding the payment of closing costs and allocation of funds.

A clear communication strategy at this stage can help facilitate a smooth closing process.

Post-Closing Responsibilities for Lenders

The responsibilities of lenders do not end once the loan has closed. They must handle servicing the loan, which includes:

- Sending out monthly statements and payment reminders.

- Managing escrow accounts for property taxes and insurance.

- Responding to borrower inquiries and account updates.

Effective post-closing service is instrumental in fostering long-term relationships with borrowers, potentially leading to future business opportunities.

Improving Efficiency in the Mortgage Process for Lenders

Best Practices for Lender Communication

Effective communication is a cornerstone of a successful mortgage process. Lenders should consider these best practices:

- Establish consistent touchpoints with borrowers throughout the process.

- Utilize various communication channels to keep clients informed (phone, email, instant messaging).

- Encourage feedback to identify areas for improvement.

Implementing these steps can help build rapport and trust with borrowers, ultimately leading to improved customer satisfaction.

Utilizing Technology in Mortgage Processing

The integration of technology can significantly enhance the mortgage process. Some effective uses of technology include:

- Automating the underwriting process with advanced algorithms that assess applications quickly and accurately.

- Implementing online portals for document submission and client communication to streamline interactions.

- Using data analytics to assess application patterns and optimize operational efficiency.

Awareness of new technologies can lead to competitive advantages in the market.

Measuring Success: Key Performance Metrics

For lenders, measuring the success of the mortgage process is essential to identify strengths and weaknesses. Key performance metrics to consider include:

- Time to close: The average number of days it takes to complete a mortgage transaction.

- Approval rates: The percentage of applications that are approved versus those that are denied.

- Customer satisfaction scores: Metrics gathered from borrower feedback post-closing.

Regularly reviewing these metrics can inform strategies to enhance the mortgage process and ultimately improve client experiences.